A golden opportunity is frequently being missed due to a lack of financial incentives to study old inexpensive generic drugs for new indications. Imagine that you discovered that a combination of off-patent (“generic”) drugs worked to better treat pancreatic cancer, which otherwise kills 95% of sufferers within five years of diagnosis.

This may sound like science fiction, but it was the experience of Dr. Steven Bigelsen, who was diagnosed with stage 4 pancreatic cancer and used 2 inexpensive generic drugs in addition to his chemotherapy to become a 5-year survivor, now 4 years in complete remission. It was the scientists at the Salk Institute for Biological Studies, not big pharma, that made the discovery that paricalcitol, a form of vitamin D, used by Bigelsen, might be useful to treat pancreatic cancer.

The Problem: Mis-aligned Incentives

Without the ability to perform human trials themselves, and without the ability to profit from their discovery, it has taken well over 20 years since their discovery to finally begin significant clinical trials on this extremely safe and inexpensive drug.

-

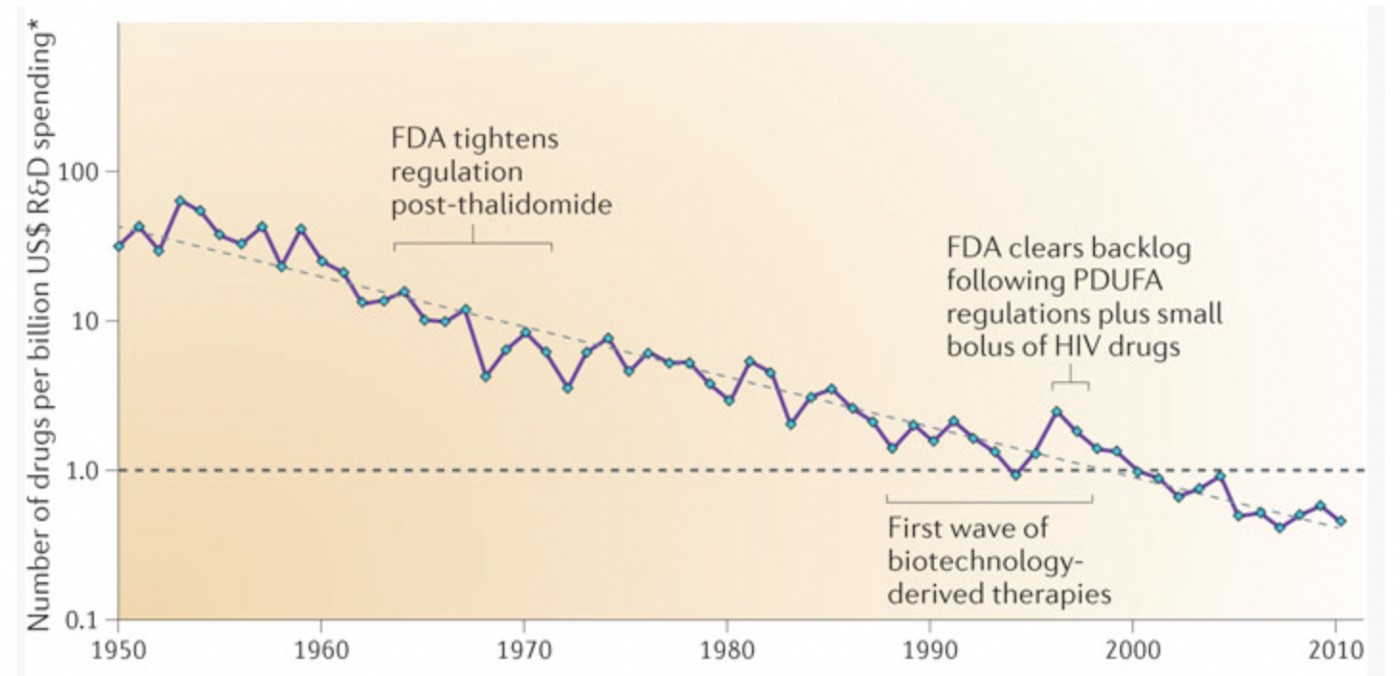

Eroom’s law: Pharma R&D productivity via patented drugs decreasing as costs of developing a new drug double every 9 years — the opposite of “Moore’s Law”. Source: Scannell, Jack W., et al. “Diagnosing the decline in pharmaceutical R&D efficiency.” Nature reviews Drug discovery 11.3 (2012): 191–200.

The investment required to develop a new drug is increasing exponentially: estimated to cost USD $1–3 billion and take over 10–15 years from discovery until regulatory approval [1]. By comparison, it can cost less than $10–15 million to obtain regulatory approval for repurposing a generic drug or nutraceutical, and less than 1-3 years, because it has already been proven safe in animals and humans.

For this reason, generic drug repurposing saw heightened interest during the COVID-19 pandemic [2]. However, easy access combined with a lack of private incentives to conduct large “gold standard” randomised controlled trials (RCTs) has caused significant public harm.

For example, millions of people self-medicating with unproven off-patent treatments based on low-quality clinical trial data, political leanings, and emotional conviction rather than following the science, leads to unnecessary harm and a supply problem for proven uses, with Hydroxychloroquine (HCQ) and Ivermectin being the key recent examples.

Without patent protection, no pharmaceutical company will fund the large and expensive clinical trials required to definitively prove these safe and inexpensive treatments are effective in humans (or just as importantly, publish the socially valuable negative clinical trial data proving which treatment protocols are not effective).

A Note on Reformulated Generic Drugs

It may be possible to patent a reformulation of your generic drug(s), but this will not be commercially viable if you cannot prevent doctors prescribing the “old” generic drug(s) off-label, or if patients can buy it cheaply in a pharmacy or online. Reformulating drugs has also been criticized as “evergreening” (which the pharmaceutical industry refers to by the euphemism of ‘pharmaceutical patent life-cycle management).

This is where pharmaceutical companies try to game the patent system by patenting a reformulation just before their old drug goes generic and then using marketing to encourage prescribing of the new formulation and discouraging substitution with the old generic drug which may be just as effective. Classic examples include the reformulation of AstraZeneca’s heartburn drug Prilosec into the heavily-marketed ‘purple pill’ Nexium.

On the other hand, reformulations that result in incremental improvements to medicines are not a bad thing if they lead to significant improvements over time. Whether evergreening strategies are adequate to ‘rescue’ unmonopolizable therapies is discussed in Chapter 3 of Mr. Kerdemelidis’ 2014 master’s thesis.

Utilising Unmonopolisable Therapies

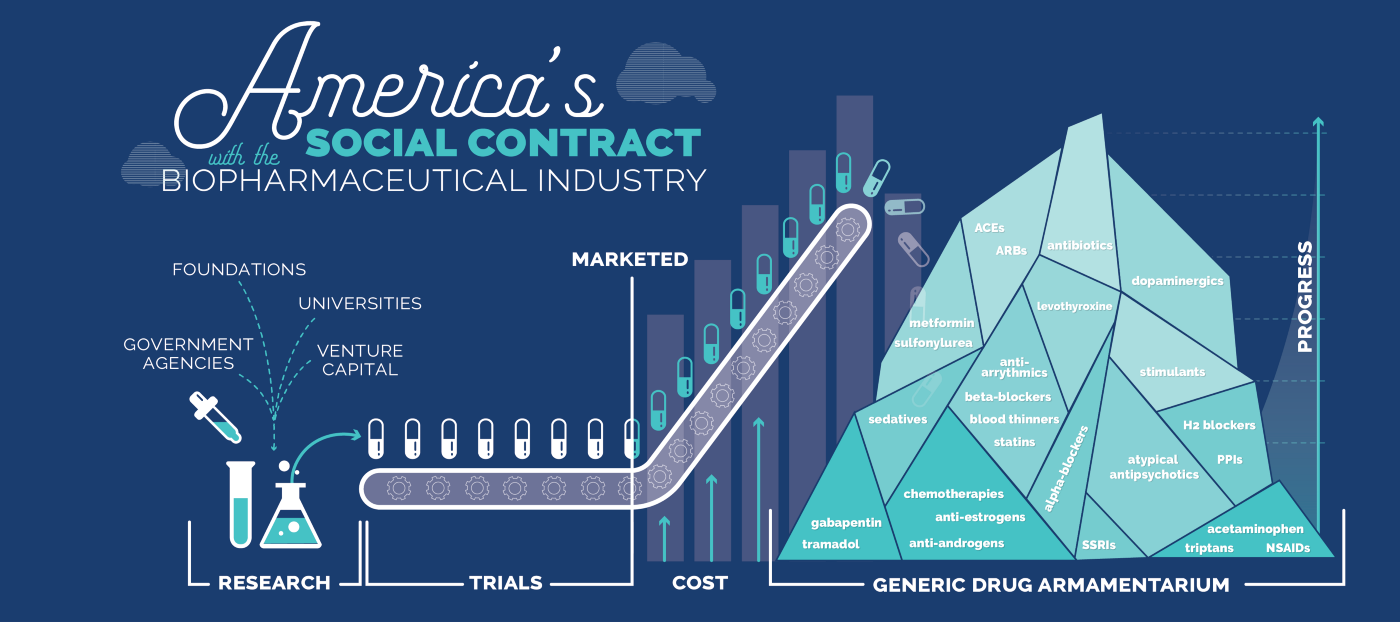

This is not a small nor isolated problem. There are thousands of FDA-approved generic drugs, with sometimes over a dozen or more being added to the generic drug armamentarium every year as branded drugs fall off the so-called “patent cliff”. This results in their price dropping close to the marginal cost of production due to competition by generic drug companies. There are also over 50,000 off-patent dietary supplements or Generally Recognised As Safe (GRAS) compounds, also referred to as “nutraceuticals”, with over 1000 introduced annually [3]. Further, plant-based medicines including cannabis & psychedelics, and also recreational drugs such as ketamine and MDMA fall within this category of “unmonopolisable therapies” because they are available for relatively low cost from multiple vendors.

This vast dataset of safe and affordable off-patent compounds is available to be prescribed by doctors to treat new diseases. However, they are all but ignored by the pharmaceutical industry: once a drug or active ingredient goes off-patent, its chance of obtaining regulatory approval to treat a new disease indication drops to almost zero [4].

Therefore, such repurposed generic drugs and nutraceuticals are considered “financial orphans” that lack private incentives to conduct clinical trials in humans, despite the potential for billions of dollars in healthcare cost savings for repurposing off-patent drugs. Like Dr. Bigelsen’s proposed off-patent treatment protocol for pancreatic cancer [5], they usually sit on a laboratory bench, the only evidence of potential efficacy in a few obscure papers, case studies, or small, poorly-funded or controlled trials.

These unmonopolisable therapies start forming a mountain of generic drugs that are, essentially, public goods suffering from a “tragedy of the commons” under the patent system. In particular, a public good is a “non-rivalrous non-excludable” good that be used by anyone without paying for it, so a free-rider problem arises. Information is the ultimate public good because it can be shared and used by anyone for free.

Note: “Unmonopolisable therapies” are a subset of ‘financial orphan’ therapies, the latter of which can be considered a broader class of unprofitable therapies that lack a sizable market such as rare diseases, tropical diseases, and antibiotics.

Free-Riders

This means that if one company pays for the expensive clinical trials showing that a specific treatment protocol for an off-patent drug works in a new indication, they cannot prevent others from “free-riding” on this valuable information, once it is published online. Even if a new use or formulation was patented, people would know they could take the “old” generic drug off-label, rather than paying a higher price for the company’s “new” branded version of the drug (which has the same or similar active ingredient as the generic).

Accordingly, there are currently no mechanisms to reimburse a pharmaceutical company for their costs of repurposing an off-patent medicine, even if this could lead to significant healthcare cost savings and public benefit.

Governments and charities have attempted to address the gap through direct grant funding, but these tend to focus on basic research with the pharmaceutical industry expected to fund large clinical trials, due to the relatively high costs and risk of failure, and the risk of a political backlash if the clinical trial fails [14].

The Issue of Taxpayer Risk

The Pepcid AC (famotidine) COVID-19 Study raised red flags weeks after the $21M grant was awarded. Concerns over study integrity, outcome measures, and even administrative protocols were all brought to light. Ironically, direct grant funding such as this can lead to even more risk and wasted taxpayer funds, such as US$150 million of federal funding on the dietary supplement curcumin studied in more than 120 clinical trials, with no tangible evidence that it is an effective treatment for any medical condition.

Further, conservative estimates of the expense of the clinical trials for repurposing a specific class of existing drugs (phospholipidosis-inducing CADs) to treat Covid-19 may be over $6 billion US dollars [6]. A market mechanism would have been more efficient—or at least not expose taxpayers to the risk of failed RCTs.

While government grants result in inefficient and sometimes controversial funding, public and private payers bear the significant financial burden of treatment, hospitalisation, chronic and end-of-life care. This results in a real tragedy, putting roadblocks in the way of medical innovation to more safe and affordable treatments and cures. The current model for the development of medicine is viewed through the lens of the centuries-old patent system, rather than as public goods.

Implementing new incentives holds the promise of blunting the age-old tragedy of the commons and redefining private incentives necessary to develop therapies like the one that saved Dr. Steven Bigelsen’s life. Meanwhile, millions of others will continue to suffer and die from this illness, and others like it because researchers struggle to obtain funding for large clinical trials involving off-patent medicines.

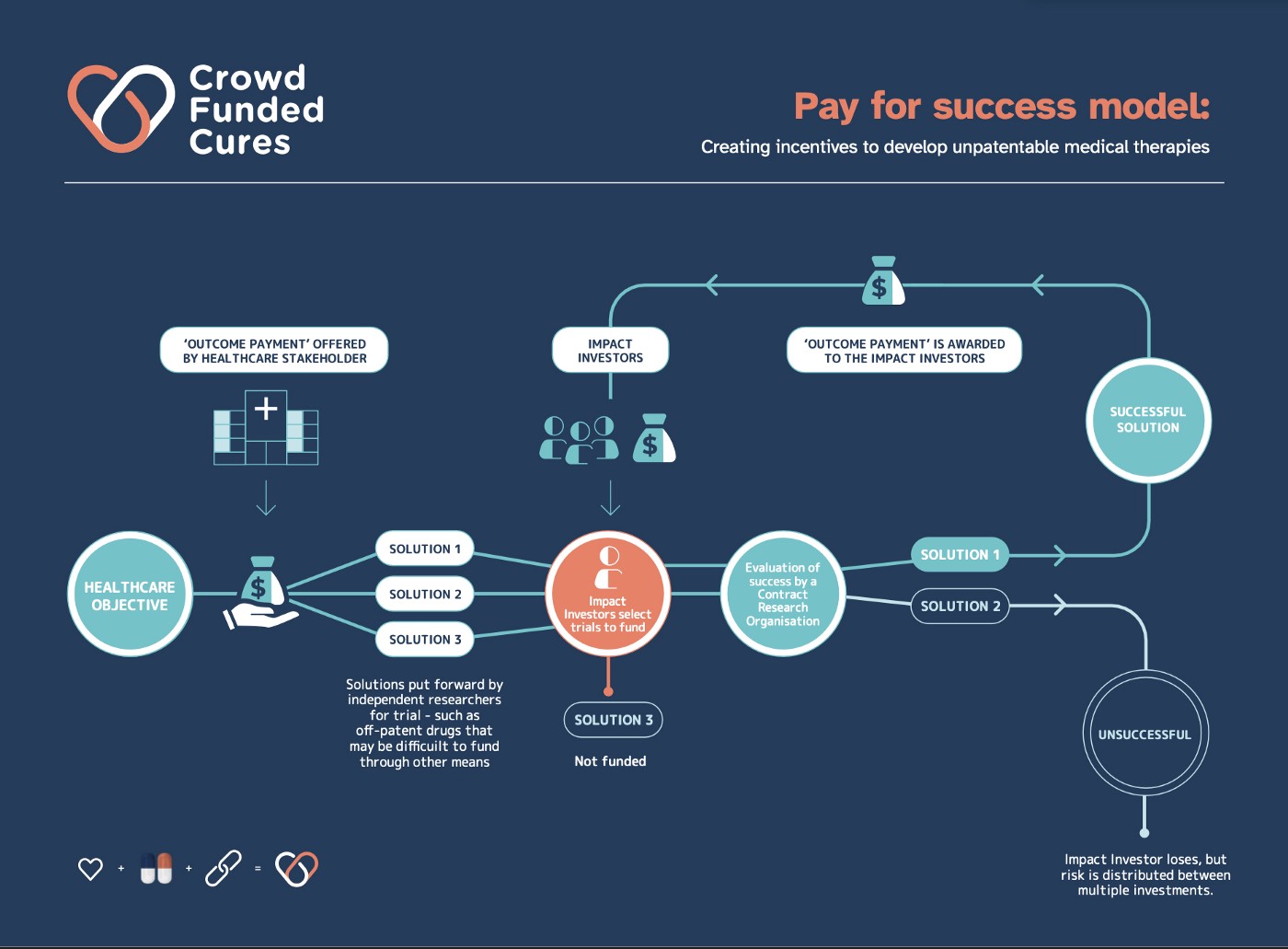

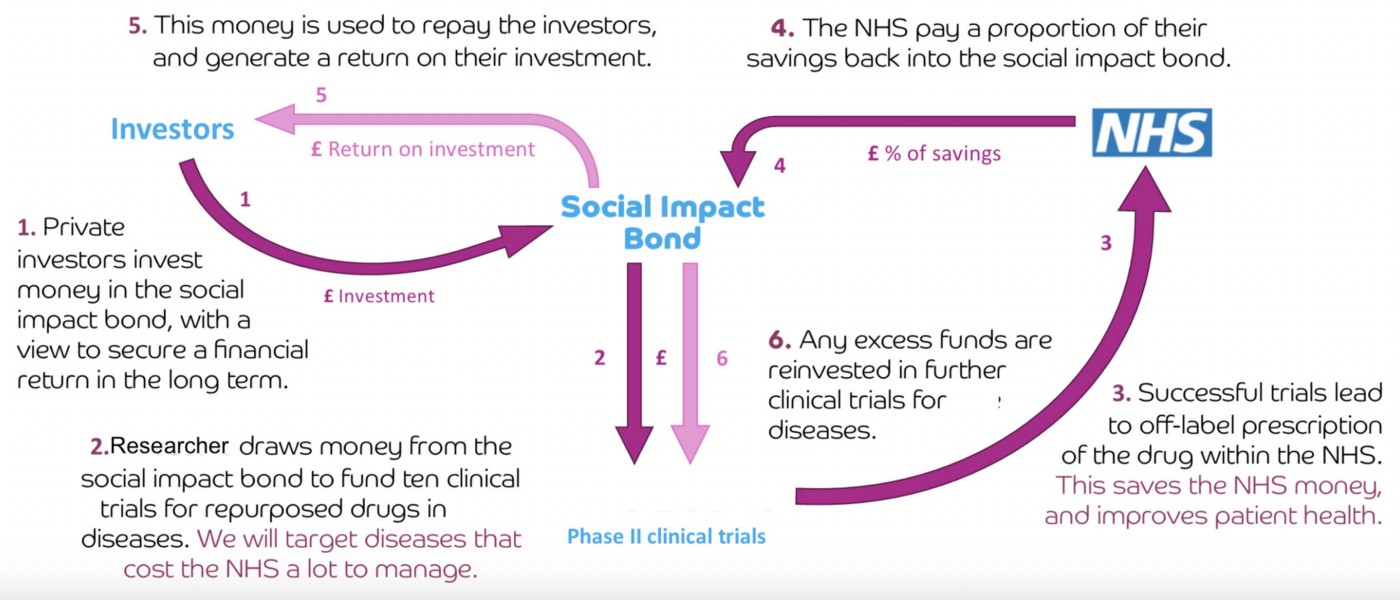

Pay-for-Success Contracts

Crowd Funded Cures proposes a market-driven incentive mechanism to fund research for therapies that cannot attract private capital due to the inability to enforce patent protection. This leverages innovative “pay for success” funding models (e.g., Social Impact Bonds (SIBs), flexible prize funds or retroactive public goods funding) that transfer risk of generic drug repurposing to the market. Pay for success contracts are designed to incentivise impact investors to fund large Phase II/ III randomised controlled trials (RCTs) for a specific indication in return for outcome payments from the fund if successful (see Fig 1 above).

Impact investors will be motivated by the market ROI (5–10% p/a) paid over a period of time (e.g. 5–10 years) and subject to Phase IV surveillance trials showing the safety and efficacy of the off-patent treatment protocol is maintained over time. The impact investment opportunity can be made more attractive (above market ROI) if payers such as governments, health insurers, or philanthropy also provide matched funding without an expectation of return — effectively acting as follow on investors but relying on the impact investors to act as lead investors and pick the winners (i.e. market generates the “signal” for which promising off-patent repurposing RCTs to fund).

This can be compared to the current system of traditional direct grant funding for generic drug repurposing where payers take on all the risk of RCT failure and rarely results in new and useful discoveries because payers are risk-averse and do not have the best experts (although the NHS-funded RECOVERY trials and discovery of repurposed dexamethasone to treat Covid is a salient recent exception).

To ensure unbiased and high-quality RCTs that can have the biggest health impact for payers and on patient standards of care, independent Contract Research Organisations (CROs) are provided with the off-patent treatment protocol (e.g., the generic drug(s) and their dosing regimen) that fulfills robust RCT design criteria (e.g., high thresholds for statistical significance, fixed inclusion/exclusion criteria, and clinical outcomes). The CROs then recruit patients into the RCTs, randomise them into treatment and control arms, analyse the raw RCT data and report on whether the clinical outcome(s) were achieved.

Outcome Payments

Outcome payments are disbursed from the fund to impact investors according to the value of the treatment protocol RCT data and/or a subsidised price for repurposed generics achieving regulatory approval with a new label for a certain period equivalent to what would have been the monopoly price (e.g. 5–10 years).

The latter is a kind of quasi-“advance market commitment” which solves the last mile problem by incentivising impact investors to convince doctors to prescribe the repurposed generic to patients, who only pay for the marginal cost, and the impact investor gets the subsidised price for each prescription from the fund. It also ensures if there are safety or long-term efficacy issues, the repurposed generic will no longer be prescribed.

The value of the RCT data and/or subsidised “monopoly” price of the repurposed drug is determined by a standard pharmacoeconomic assessment that payers undertake for standard patented drugs (e.g., $50k per QALY, or Quality-Adjusted-Life-Year) that considers the incremental cost savings.

“Prize-like” pull-incentives to address market failures for development of new drugs for rare, pediatric, or neglected diseases or antibiotics have been implemented in the past, such as transferrable priority review vouchers that can be sold for between $50–350 million as they can add 6 months to the period that a drug is on patent, and advance market commitments that pay a subsidised price for new drugs that would otherwise not be profitable enough to develop.

However, vouchers are somewhat crude “lump sum” fixed prizes are susceptible to gaming because they are not linked to the QALY impact of the medicine, and advance market commitments have not been proposed for repurposing off-patent medicines [18].

As noted above, it is over 100x cheaper to repurpose generic drugs, so the cost per QALY under a pay-for-success model should be much better value for money (e.g. $5–10k per QALY) vs patented drugs ($50k–150k+ per QALY), which means repurposed generics would outcompete patented drugs based on price unless they are true medical breakthroughs providing exceptional value for society.

Leveraging Blockchain: Retroactive Public Goods Funding, DAOs, and IPNFTs

We envision administering pay for success or SIB smart contracts as a Decentralised Autonomous Organisation (DAO), a novel type of organisation that runs autonomously on a blockchain protocol and enables participation by virtually any person or entity across the globe via CFC Tokens.

This idea is similar to the concept of Retroactive Public Goods Funding proposed by Vitalik Buterin to fund public goods, but where the smart contract criteria for outcome payments are calculated with reference to specific clinical outcomes in an RCT and less discretionary, which reduces the risk of collusion/rent-seeking. CFC Token holders interact with pay-for-success smart contracts on the DAO’s open distributed ledger (blockchain) to ensure transparency and immutability across a variety of inputs (e.g. research protocol, success criteria) and deterministic outputs (e.g., outcome payments).

Administering pay-for-success smart contracts on a blockchain also enables intellectual property like RCT results to be encrypted and locked to the distributed ledger as an Intellectual Property Non-Fungible Token (IP-NFT). The IP-NFT enables fractionalized licensing of IP rights and access to third parties that could benefit from the research findings. For an example, see this article on Molecule’s IP-NFT model.

Accessing the IP Data

Access to successful RCT data represented by the IP-NFT is locked until the fulfillment of the clinical outcome criteria for an outcome payment under the pay for success smart contract, but unsuccessful RCT data is automatically unlocked and published as useful “negative information” showing which off-patent treatments do not work. If the criteria for an outcome payment include achieving regulatory approval for the new indication, the newly labeled generic will be eligible to receive a subsidised price for each prescription or lump sum outcome payment per course of treatment.

IP-NFTs can be locked as a trade secret until an appropriate outcome payment or subsidy for the repurposed generic can be determined, which allows a market mechanism for price discovery. CROs and regulators are already required to keep RCT data involving patented drugs secret, so the concept is not usual. Outcome payments can also be determined in advance according to clinical outcomes such as regulatory approval, statistically significant improvement vs usual care, and percentage reduction in rates of hospitalisation vs usual care.

Price Determination

The issue is that the subsidised price must be determined by payers in advance, which may be difficult before the RCT results are available. However, alternative algorithms/formulae to provide outcome payments can be pre-determined based on health outcomes shown by the RCT data rather than reimbursement via the sale of “branded” generics.

For example, a branded generic might represent fixed monthly or annual funds allocated between “registered” IP-NFTs proportional to percentage (%) reduction in hospitalisations vs usual care shown in the RCT data. The latter mechanism allows a “market equilibrium” to arise because the amount of outcome payments decreases when more IP-NFTs are registered and decreases as the IP-NFTs automatically deregister after a fixed period of time (e.g. 5–10 years). It also incentivises incremental improvements to health outcomes as well as breakthroughs.

Leveraging the Blockchain & Free Market

IP-NFTs provide a source of revenue for the DAO’s treasury by funding successful RCTs for off-patent therapies. CFC Token holders can act as impact investors that fund RCTs for off-patent therapies in return for eligibility to receive an outcome payment under the pay-for-success smart contract in proportion to their fractional ownership of the IP-NFT if the RCT data represented by the IP-NFT fulfills the success criteria for payout.

This validation of the raw RCT data is determined by a Results Oracle operated by the independent CRO that generated the RCT data by applying the off-patent treatment protocol. By allowing CFC Tokens to be purchased and sold on crypto exchanges, those impact investors that are most able to fund successful RCTs are more likely to purchase CFC Tokens which are eligible for an outcome payment, which helps drive up the price.

Conversely, those CFC Token holders less likely to fund successful RCTs are more likely to sell their CFC Tokens. This will result in markets driving aggregation of CFC Tokens to those impact investors that are the most efficient at allocating resources towards funding successful RCTs [20].

This dynamic of SIBs was a core advantage of the Health Bond proposal by Ronnie Horesh, the NZ economist who first conceived of SIBs in 1988. By allowing tradeable SIBs, the markets will ensure the most efficient allocation of resources to those best able to maximise health impact. See proposal to trade a “Health Impact Token” on the crypto markets.

Crowd Funded Cures proposes creating SIB smart contracts backed by payers where CFC Token holders can act as impact investors and fund the generation of off-patent RCT data encrypted into IP-NFTs, which are unencrypted upon achieving success criteria for an outcome payment, as determined by an oracle managed by an independent CRO.

By allowing CFC Token holders to invest in off-patent IP-NFTs and trade their rights to receive outcome payments under SIBs on crypto exchanges, the markets will ensure an efficient allocation of resources to the CFC Token holders that are best able to invest in the generation of successful RCT data via IP-NFTs that maximises health impact (and outcome payments under the SIB), by tending to aggregate CFC Tokens due to their increase in market value.

Thus, using blockchain technology, it is possible to conduct real-world economic experiments in financial innovation to allow stakeholders to co-operate in a self-interested way to solve the public goods problem for off-patent medicines [21].

A Pilot Study & Proof-of-Concept

The main bottleneck to implementing a pilot is to fundraise a payer fund or find a payer willing to purchase successful off-patent RCT data or a subsidy for repurposed generic drugs represented by IP-NFTs in order to reduce disease burden for a specific indication (e.g., COVID-19, pancreatic cancer, depression, Alzheimer’s, multiple sclerosis, amyotrophic lateral sclerosis, Crohn’s disease, longevity

Repurposing off-patent drugs and nutraceuticals such as metformin, resveratrol, NMN, and rapamycin for improving longevity by addressing the direct causes of aging has the potential to result in a massive reduction of overall disease burden as most diseases are associated with these causes, including cancer, dementia, cardiovascular disease, and arthritis.

It is also possible to fundraise the payer fund through the issue of Open Source Pharma NFTs available via the Crowd Funded Cures platform that represent tiered donation amounts (e.g. bronze, silver, gold, platinum, diamond, for specific disease indications and/or proposed therapies) locked into pay for success smart contracts that either (a) provide funding for particular RCTs a donor supports on the impact investor side or (b) form part of the outcome payments made to impact investors for successful RCT data encoded within an IP-NFT on the payer side.

Crowd Funded Cures is currently working with VitaDAO.com to establish a Pay-for-Success Contract x IP-NFT pilot to support clinical trials for off-patent open source medicines that improve longevity such as a $400k Phase 2 RCT by Dr Brad Stanfield to study the effect of generic rapamycin + exercise to improve strength in the elderly. We are leveraging part of a Longevity Prize to raise a $1m payer fund as an incentive for impact investors to fund such RCTs using VitaDAO’s IP-NFT framework. Donations on Stripe via the crowdfundedcures.org website and our NZ charity’s ETH address will support this pilot:

0x188ad16bb967b039640d8fcc7648462514519d85

(Please contact us to confirm receipt of a test amount if in doubt).

Unlocking a Trillion-Dollar Market

The goal of our Pay-for-Success model is to open up R&D within the pharmaceutical sector to new incentive models with respect to unmonopolisable therapies, which has the potential to disrupt an industry via the generation of valuable off-patent RCT data. There is a total addressable market of $1.67 trillion in cost savings for payers in the US alone—per the 2017 AAM report on generic drug savings.

If success payers were to transfer only 1% percent of these cost savings into repurposing SIBs, there is an untapped arbitrage opportunity to capture potential revenue of over USD$16.7 billion to drive generic drug repurposing innovation. Assuming it can be up to 100x cheaper and 10x faster to repurpose generics (as it is possible to start Phase 3 trials immediately, versus developing new drugs where you need to start from the beginning in animal trials), this creates an arbitrage opportunity and scalable business model instead of relying on inefficient and risky direct grant funding where you need to pick which RCTs are likely to succeed.

Payers don’t want to fund large RCTs directly—they aren’t designed to innovate new products and fail fast. There is also a free-rider risk for payers that directly fund RCTs. A SIB, administered by Crowd Funded Cures, can engage with a syndicate of multiple payers to sign the same pay for success contract, where they agree to share costs and provide exclusive advance market commitments or outcome payments to the impact investor that has repurposed the “branded” generic, with the subsidised price calculated by linking RCT outcomes to QALYs gained.

This will create a microeconomic ecosystem that outsources this generic drug repurposing innovation to impact investors to save overall healthcare costs and reduce free-riding. With a network of payers backing a SIB, it will be possible to build a scalable business model and private investment opportunity where none existed in the past.

Main Obstacles

Before our Pay-for-Success contracts are implemented at scale, there are some common hurdles that need to be addressed. These are technical, educational, and legal concerns that have great influence over the implementation of our IP-NFT PFS model. Below is a brief discussion of some of the more pertinent concerns.

Healthcare Payers do not pay for cost savings or value generated by a repurposed generic drug rather than the lowest market price

We understand that the main obstacle to obtaining backing for a generic drug repurposing SIB is that healthcare “single payers” such as the NHS do not pay for health savings due to a specific intervention because of difficulties in measurement and accounting (e.g. RCT data showing that a generic drug treating a new indication reduces hospitalisations).

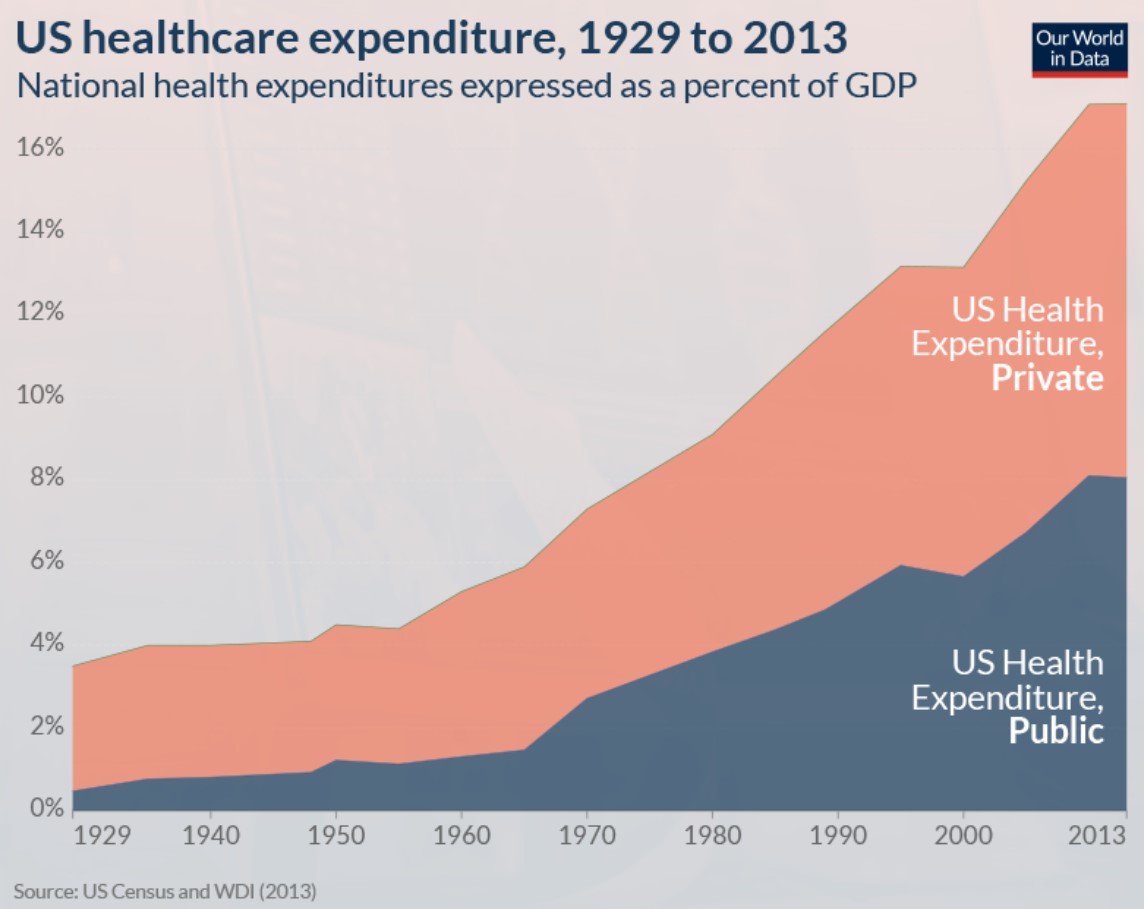

In addition, large health insurers (particularly in the US) often own hospitals and are not incentivised to reduce healthcare costs. Everyone in the healthcare industry is making too much money from the status quo, but this will soon become unsustainable due to an aging baby boomer population. Payers also do not buy a generic drug for more than the lowest price available for the active pharmaceutical ingredient (API), rather than agree to a value-based / differential price or advance market commitment for a particular “branded generic” in a new indication.

Essentially, payers do not currently agree to put a price on the treatment protocol information about which generic drug works in a new disease and the optimal dose, versus the marginal cost of purchasing the generic drug and its associated API as a chemical. This is a bit like only paying an electrician for the cost of a new $1 part made in China, rather than the knowledge of which specific part is needed to fix an electrical fault, which is the truly valuable information that takes years of experience and would save your business $100s of dollars or more.

However, with the trillions of dollars available in healthcare cost savings from repurposing low-cost generic drugs and nutraceuticals to treat new diseases, perhaps we can find a forward-thinking payer willing to purchase successful RCT data validating the safety and efficacy of off-patent treatment protocols that can reduce their healthcare costs. Payers may be convinced to set aside a generic drug repurposing fund for subsidies or outcome payments under a pay-for-success contract, which allows differential or value-based pricing for a new generic indication.

Over USD$500m has been raised in SIBs globally, but only approximately USD$74m has been raised in 30 health-related SIBs according to the INDIGO database operated by the Oxford GO Lab and 57 health-related SIBs in Insper Metricis Research Group (Brazil) Database. From our review of these databases, health-related SIBs mostly relate to the delivery of healthcare services and none relate to incentivising RCTs for medical research such as repurposing generic drugs.

This would be a novel mechanism to incentivise impact investment into ‘public good’ medicines. It may be possible to find outcome payers with sufficient budget for generic drug repurposing (including government agencies such as NHS, NIH, Veteran’s Administration (VA), Medicare/Medicaid and BARDA, health insurers such as UnitedHealthcare, CVS Health, Anthem, Cigna, and large philanthropy such as Gates Foundation, Wellcome Trust and Chan Zuckerberg Initiative). However, it is a significant challenge to overcome institutional inertia from payers and limited mandates to try new financing models, although payers have implemented similar ‘pay-for-performance’ contracts to manage the pricing of expensive new drugs.

Conclusion

Economists argue there are no bad people, only misaligned incentives. In the same way, we should not blame the pharmaceutical industry for gaming the patent system to maximise profits. However, we should blame our sole reliance on patents to develop new medicines. With Pay-For Success (PFS) contracts to incentivise clinical trials for off-patent drugs or unmonopolisable therapies, we can provide a more flexible and cost-effective “open source” approach alongside patents.

PFS can incentivise the generation of useful clinical data supporting personalised treatment protocols by linking rewards to successful patient outcomes, rather than maximising the sales of a single monopoly-priced drug in the general population until the patent runs out. It also takes advantage of the biotech innovations of the last 40 years, including genetic engineering, personalised medicine (informed by blood tests and low-cost DNA sequencing), blockchain, artificial intelligence, decentralised clinical trials and telemedicine, and can help pull our broken system for medical innovation into the 21st century. We hope you can join us in supporting our mission to obtain backers for PFS contracts.

References

- DiMasi, Joseph A., et al. “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs.” Journal of Health Economics, vol. 47, 2016, pp. 20–33. Crossref, https://doi.org/10.1016/j.jhealeco.2016.01.012.

- Riva, L., Yuan, S., Yin, X. et al. Discovery of SARS-CoV-2 antiviral drugs through large-scale compound repurposing. Nature 586, 113–119 (2020). https://doi.org/10.1038/s41586-020-2577-1

- Institute of Medicine (US) and National Research Council (US) Committee on the Framework for Evaluating the Safety of Dietary Supplements. Dietary Supplements: A Framework for Evaluating Safety. Washington (DC): National Academies Press (US); 2005. 1, Introduction and Background.

- Sahragardjoonegani, Babak et al. “Repurposing existing drugs for new uses: a cohort study of the frequency of FDA-granted new indication exclusivities since 1997.” Journal of pharmaceutical policy and practice vol. 14,1 3. 4 Jan. 2021, doi:10.1186/s40545-020-00282-8

- Bigelsen S. Evidence-based complementary treatment of pancreatic cancer: a review of adjunct therapies including paricalcitol, hydroxychloroquine, intravenous vitamin C, statins, metformin, curcumin, and aspirin. Cancer Manag Res. 2018;10:2003-2018. Published 2018 Jul 13. doi:10.2147/CMAR.S161824

- Tummino, Tia A. et. al. “Drug-Induced Phospholipidosis Confounds Drug Repurposing for SARS-CoV-2.” Science, vol. 373, no. 6554, 2021, pp. 541–47. Crossref, https://doi.org/10.1126/science.abi4708.