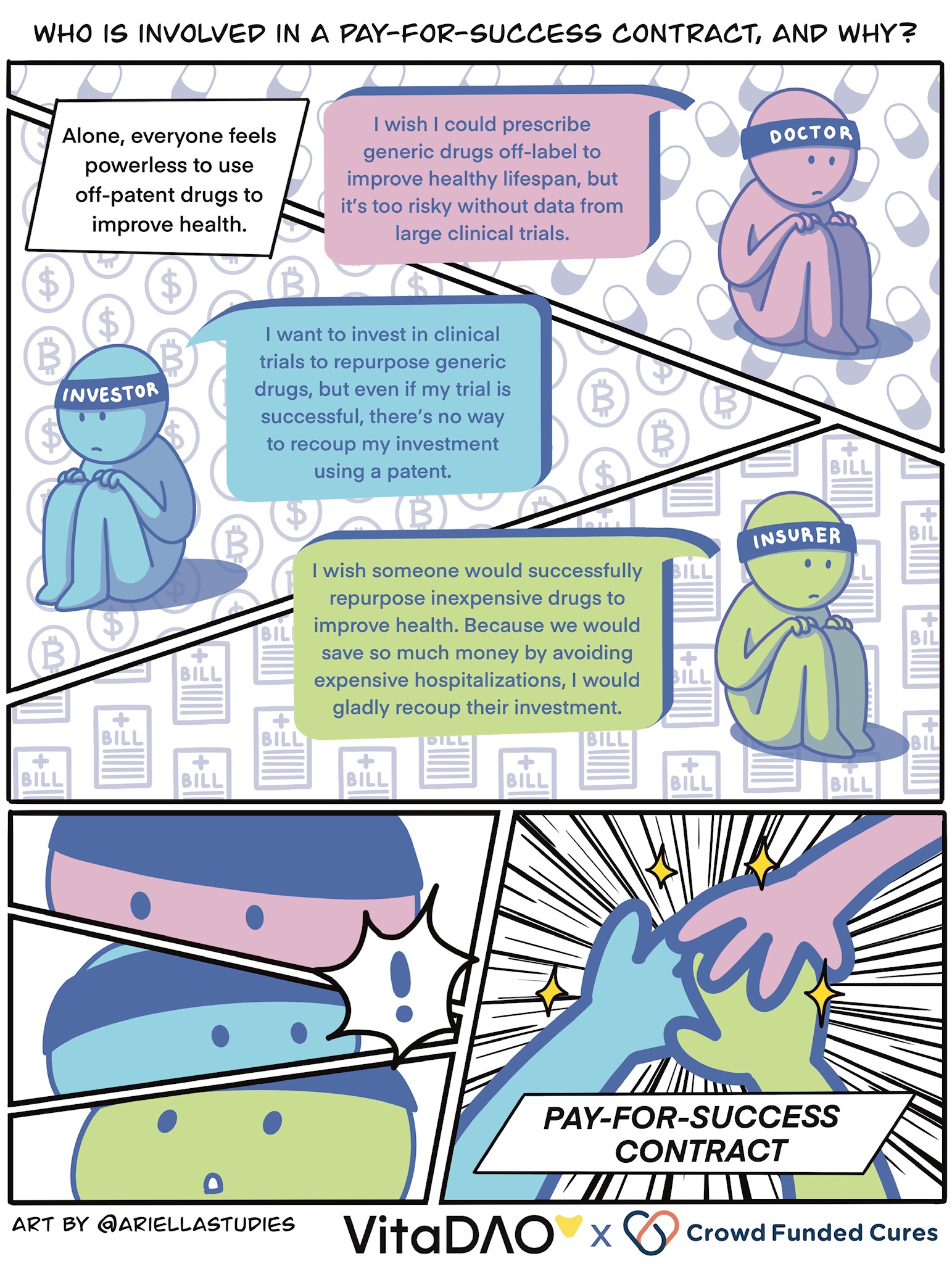

Under the current system, patent protection is critical for developing a new therapy. The large clinical trials required for obtaining regulatory approval can cost tens of millions of dollars, and patent royalties are how this investment is recouped and rewarded. Thus, if a drug is off-patent or “generic”, then it has almost no chance of being repurposed to treat a new disease, even if it would be safer and more effective than a new, patented drug.

This is because pharma companies cannot charge a monopoly price for a generic drug as they are not the sole manufacturer. Doctors can prescribe drugs for unapproved (i.e. off-label) indications based on their knowledge of small, lower-quality studies; however, they are often reluctant to do so for fear of putting patients at risk.

Introduction

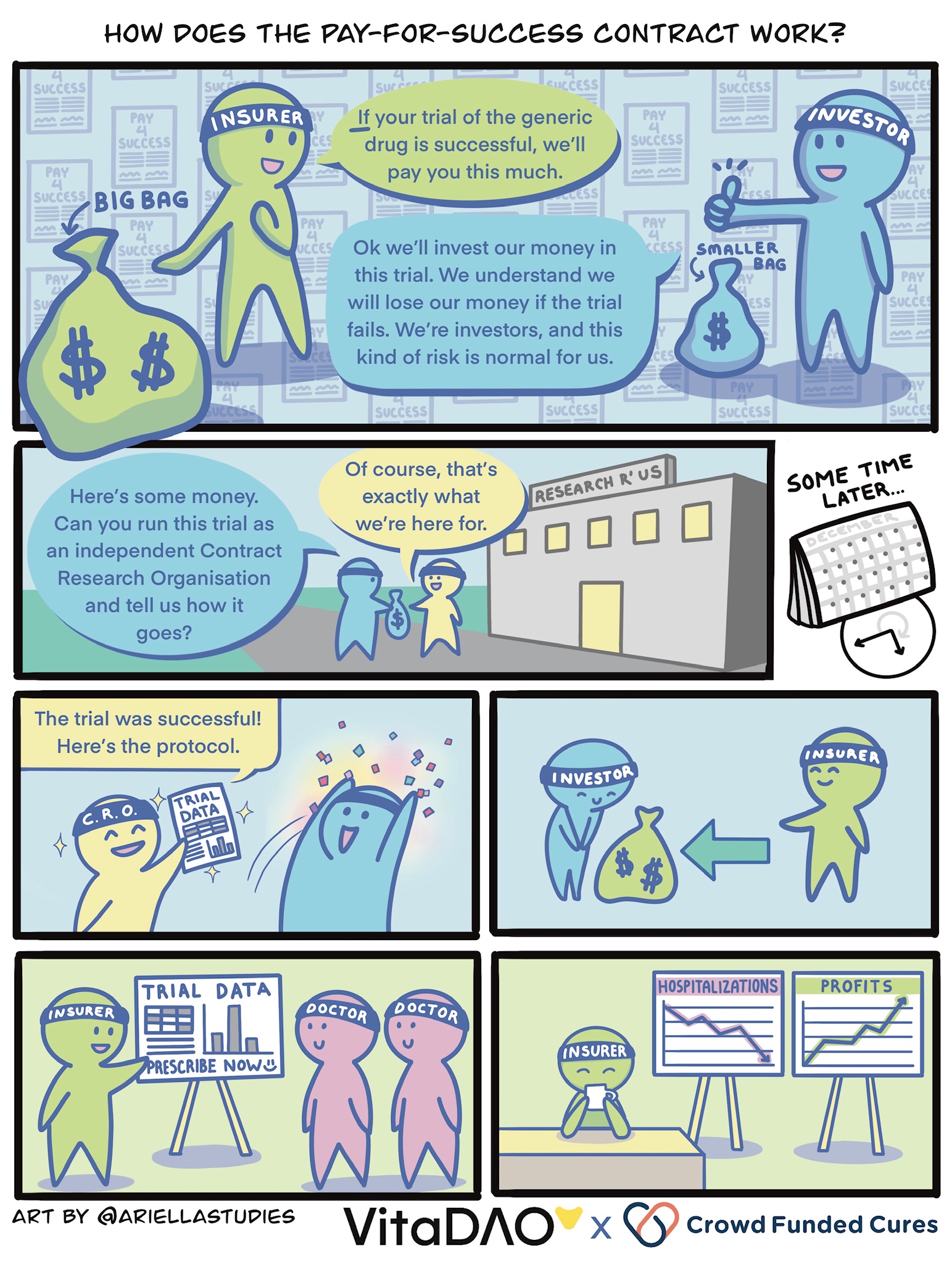

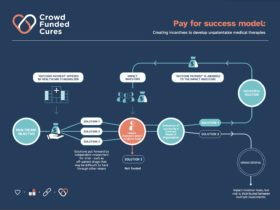

In this article, we will contrast the old way of conducting drug development (based on patenting new molecules and charging a monopoly price) with a new financially innovative “pay-for-success contract” model. Under this new system, health insurers pay a subsidised price for generic drugs based on the promise of overall cost savings through improved health and reduced hospitalisations.

This incentivises investors to repurpose generic drugs to treat new diseases, which can happen up to 100x cheaper and 10x faster than developing novel drugs under the old patent model. The reason it is so cheap and fast is because there are already years or even decades of existing safety data on generic drugs, giving clinical trials a huge head-start. Here we will provide a head-to-head comparison of these two models using generic rapamycin to treat aging as a hypothetical example.

Generic Drug Repurposing under the Current Patent Model

A researcher discovers in a small study that an off-patent drug, rapamycin, is especially effective at improving aging biomarkers at a specific dose and in patients with a specific genetic profile and age group. Unfortunately, as rapamycin is off-patent, the researcher will struggle to obtain funding for the large clinical trials required to obtain regulatory approval. Centralised grant and philanthropic funding is competitive with other more prestigious research organisations being more likely to obtain the funds.

Grant funders also do not want to take on the political and financial risk of large clinical trials failing. For this reason, clinical trials for off-patent rapamycin are unlikely to get funded and it can only be prescribed off-label by doctors, who are reluctant to do so based on smaller trials. Philanthropic funding is also difficult because of the high risk and expense of large clinical trials.

Using pay-for-success contracts, it is possible to avoid the irrational sole reliance on the patent system to fund biopharma R&D and clinical trials

The researcher approaches their university’s tech transfer office to see if they can get any industry attention. The only chance is for industry to work with patent attorneys to try to patent “rapalogs,” which are tweaked versions of the off-patent rapamycin. The tweaked rapalog molecule also has less safety data than off-patent rapamycin, so there is a potential risk to patients. One pharma company decides to fund a tweaked rapalog version of rapamycin that can be patented and raises hundreds of millions of dollars.

It obtains regulatory approval and charges billions of dollars in monopoly prices from health insurers. To make matters worse, after a few years, doctors discover that the patented rapalog is equivalent or less safe than generic rapamycin and stop prescribing the rapalog. For this reason, industry is reluctant to fund further studies into rapamycin to determine optimal treatment protocols and dosing. In short, everyone loses.

Generic Drug Repurposing under the Pay-for-Success Model

A researcher discovers in a small study that an off-patent drug, rapamycin, is especially effective at improving aging biomarkers at a specific dose and in patients with a specific genetic profile and age group. Under the pay-for-success model, the researcher does not need to rely on patent protection to raise funds to conduct clinical trials. This is because health insurers have agreed to pay a subsidised price of up to $30m for a successfully repurposed generic drug, on the basis that it will save over $100m in costs due to reduced hospitalisations overall. This conclusion is supported by a pharmacoeconomic analysis validated in a feasibility study (lower cost per quality-adjusted-life-year or QALY).

In this hypothetical example, let’s imagine a scenario where the VitaDAO community takes on the role of the investor. In order to improve efficiency, access to liquidity, and leverage tokenomics and market forces, the pay-for-success model is implemented in a trustless manner using smart contracts and Molecule’s IP-NFT framework. This allows fractionalised ownership of the generic drug repurposing clinical trial data by token holders, such as VitaDAO members who collectively provide $10m in funds towards an “Open-Source Rapamycin” IP-NFT.

Regardless of who takes on the role of the investor and generates the funds, let’s imagine that we now have $10m to spend. This $10m is used to pay an independent contract research organisation (CRO) to conduct the clinical trials, and — if successful — obtain regulatory approval and a new label for a “branded” generic rapamycin. If the rapamycin clinical trials are successful, the health insurer agreed to pre-order $20m of the branded rapamycin at a subsidised price and to purchase $10m more, assuming that clinical efficacy is maintained. The proceeds go to the investors, i.e., the IP-NFT owners, under an arrangement with the generic drug manufacturer.

The investors (in this case, the IP-NFT owners) may then fund additional IP-NFTs for clinical trials to optimise the treatment protocol for rapamycin and create better formulations. In return, they will of course receive additional outcome payments under subsequently negotiated pay-for-success contracts with the original health insurer and others. Doctors and patients globally benefit from the clinical trial data validating the efficacy of the optimal treatment protocol involving low-cost generic longevity medicines using this innovative open-source approach.

Conclusion

Using pay-for-success contracts, it is possible to avoid the irrational sole reliance on the patent system to fund biopharma R&D and clinical trials. Information about which off-patent or generic medicines are safe and effective to treat new diseases or improve healthy lifespan and their optimal dosing regimes is a quintessential public good.

By establishing this new pay-for-success model, we can ensure that researchers are empowered to follow the science rather than forcing a patentable approach. Researchers will be able to obtain funding for large clinical trials that determine which off-patent treatment protocols help patients, without reliance on patents.

Addendum for Advanced Readers

What if you cannot find an insurer to back a pay-for-success contract or there are insufficient outcome payments available to attract an impact investor? In this case, it is possible to crowdfund outcome payments from philanthropy or the public from the issuance of Open Source Pharma Longevity NFTs. These funds can be locked into a smart contract, and only payable if clinical trials are successful, as determined by a Results Oracle maintained by the CRO, using a similar method to Retroactive Public Goods Funding. It is also possible to bootstrap the pay-for-success contract using a trade secret strategy: encrypting the clinical trial results in an IP-NFT until a price is negotiated with insurers or crowdfunded from the public (via NFTs or otherwise) to unlock access to the Open Source Pharma IP-NFT and “open-source” the successful treatment protocol.

This article is presented in partnership with VitaDAO a decentralized autonomous organization (DAO) collectively funding and advancing longevity research in an open and democratic manner.